Reduce Churn by Recovering Declined Transactions

Transform Declined Transactions into Retained Subscribers

In subscription ecommerce, declined transactions can lead to involuntary churn, cutting into revenue and customer loyalty. Our advanced analytics tool uses AI-driven insights to turn these declines into recoverable transactions, helping you minimize churn and maintain a robust, engaged subscriber base.

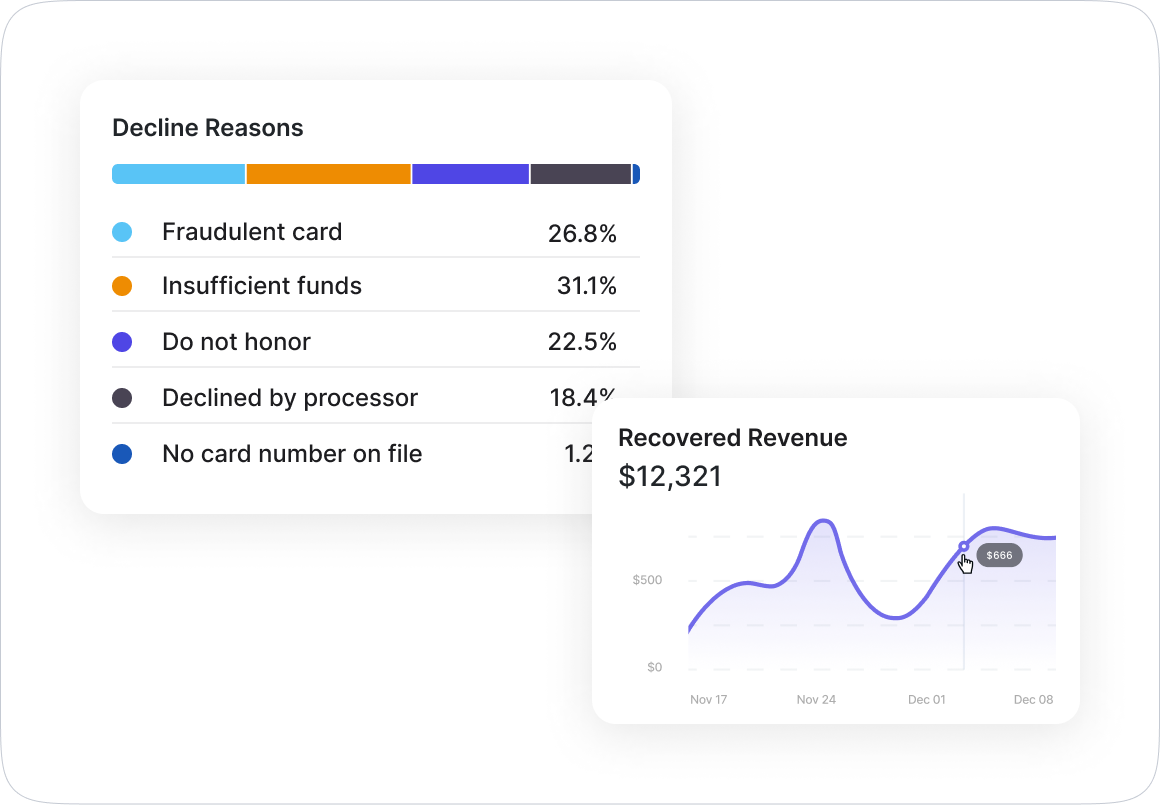

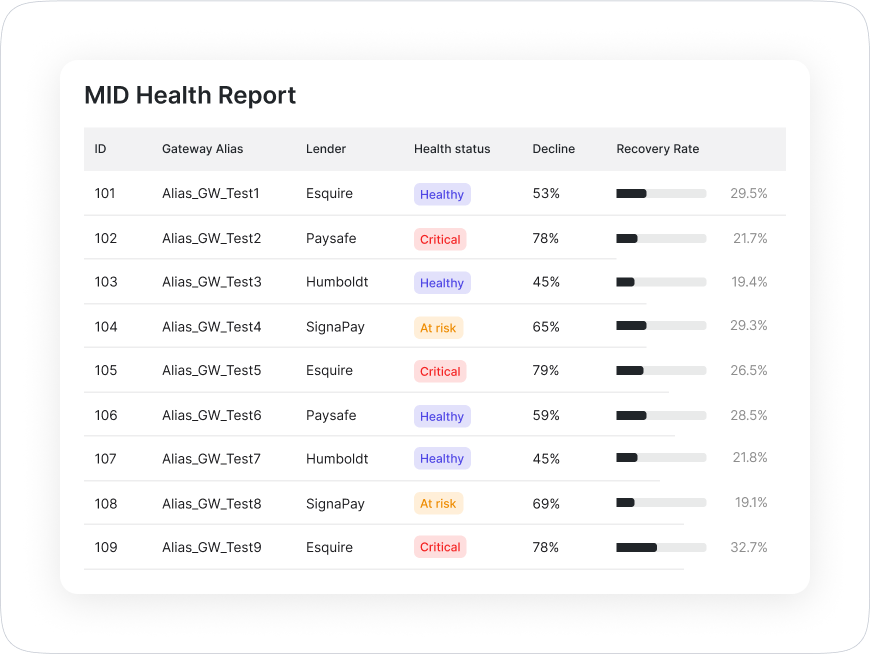

AI-Driven Decline Analysis

Our tool examines every declined transaction, identifying patterns and specific reasons for each decline. With this insight, you can implement tailored strategies to recover revenue and retain customers.

Root Cause Analysis for Decline Reasons

Understand precisely why transactions fail, whether due to expired cards, insufficient funds, or security issues. This granular data helps you take the right actions for each type of decline.

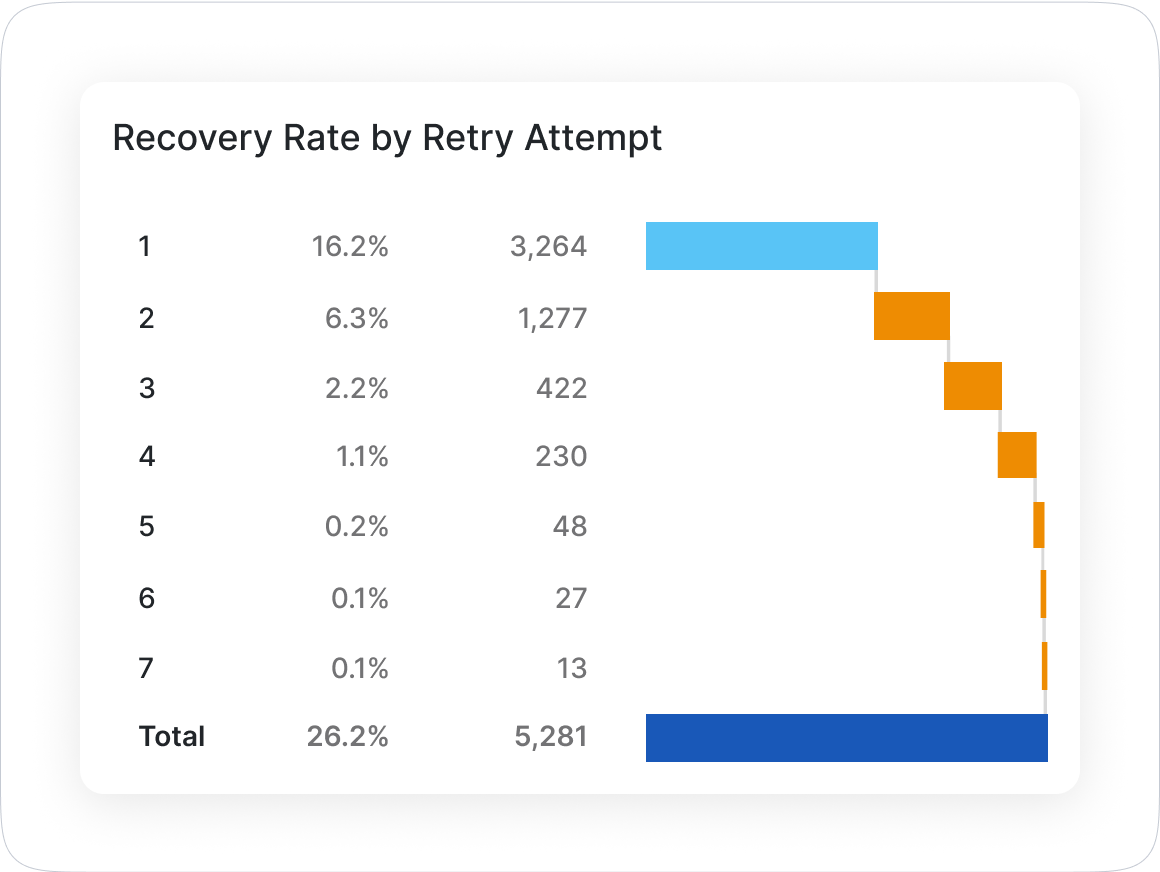

Data-Backed Recovery Strategies

Our tool recommends recovery strategies based on the root cause, such as retry logic adjustments, alternative payment methods, or personalized customer outreach. These targeted actions improve your chances of turning a declined payment into a successful transaction

Adaptive Churn Prevention with AI

Declines don’t have to mean churn. Our tool equips you to take proactive steps that keep subscribers engaged and minimize revenue loss.

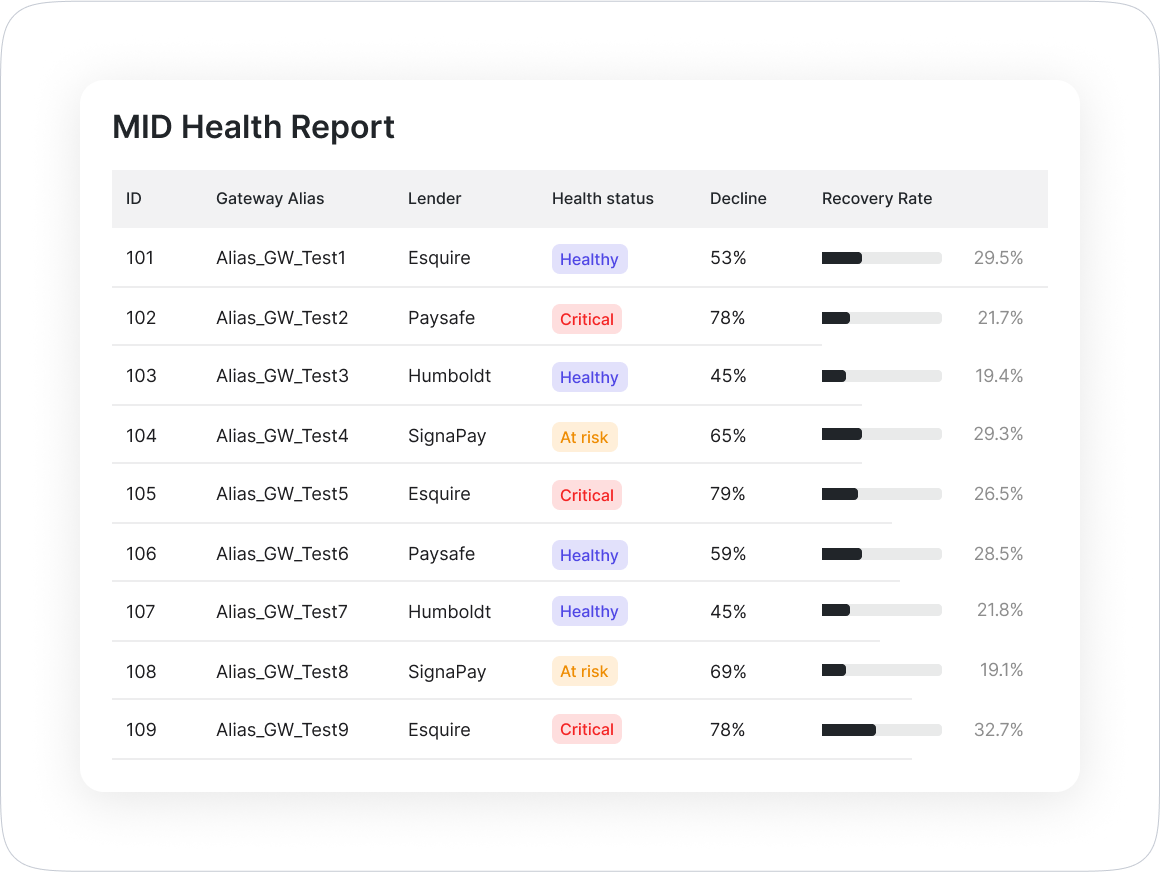

Real-Time Churn Risk Detection

Identify at-risk customers by analyzing repeated declines, account activity, and churn patterns. By flagging potential issues, our tool lets you reach out before churn becomes a reality.

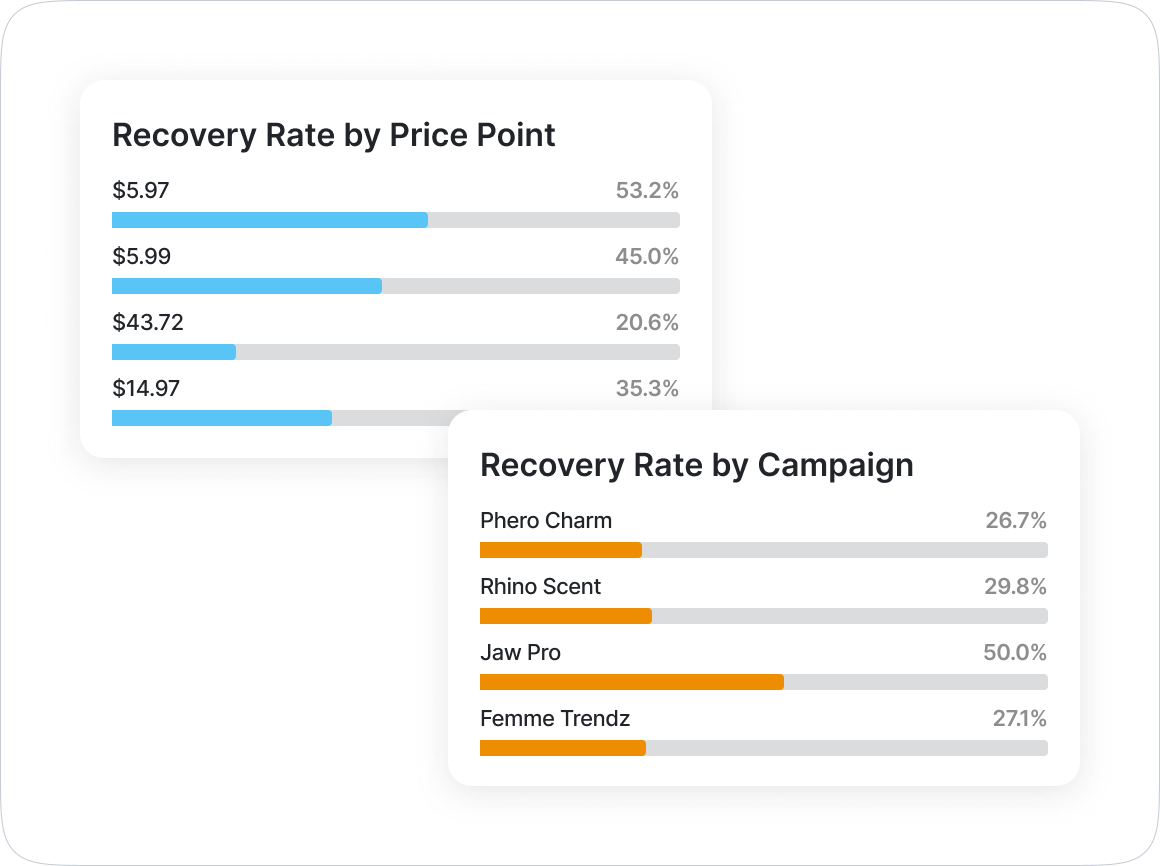

Involuntary Churn Insights

Understand trends in involuntary churn and optimize processes to address them, from improving decline recovery to refining payment methods and customer engagement strategies.

Forecast Growth with Advanced Reporting

Gain instant insights and plan ahead with our powerful reporting and predictive tools: